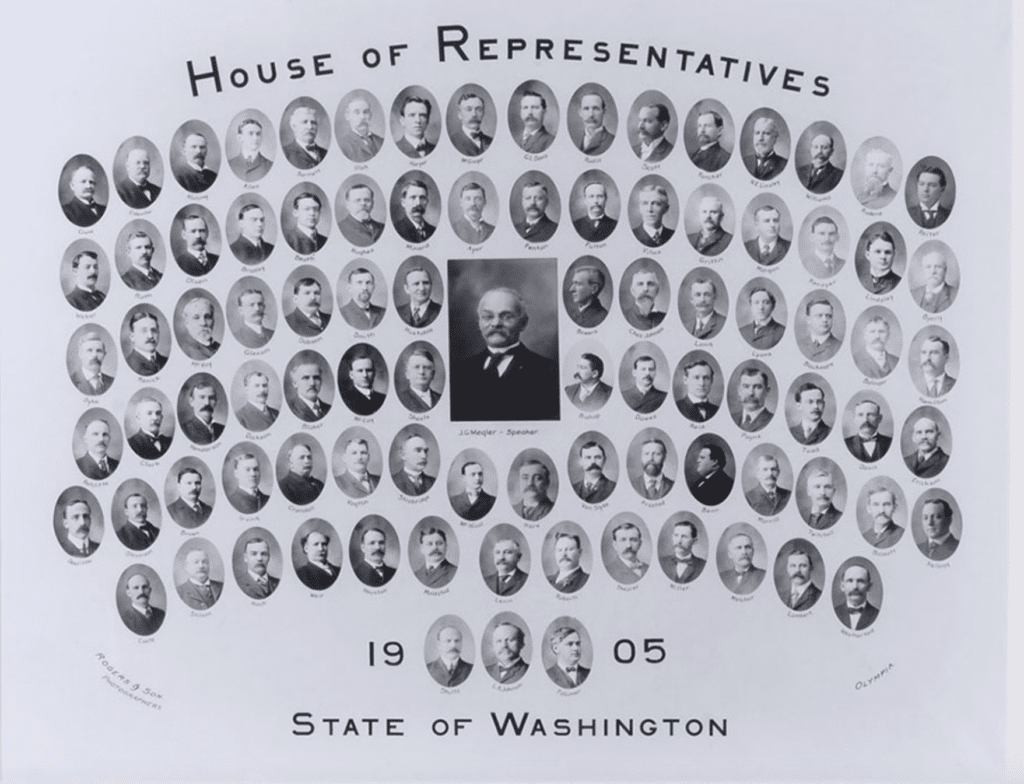

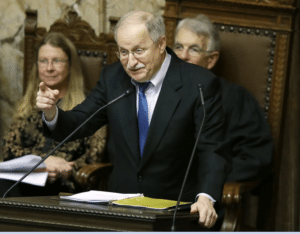

In Memoriam

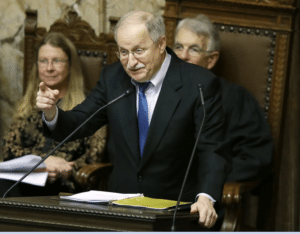

Speaker Frank Chopp, Washington State House of Representatives Longest Serving Speaker of the House

1943-2025

(Photo Courtesy: Seattle Times)

Trivia!

Washington state’s longest-serving Secretary of State Ralph Munro passed away March 20 at the age of 81. Munro hosted a popular, long-running series on TVW. What is the title of this series?

Highlights of the Week

Budgets Released

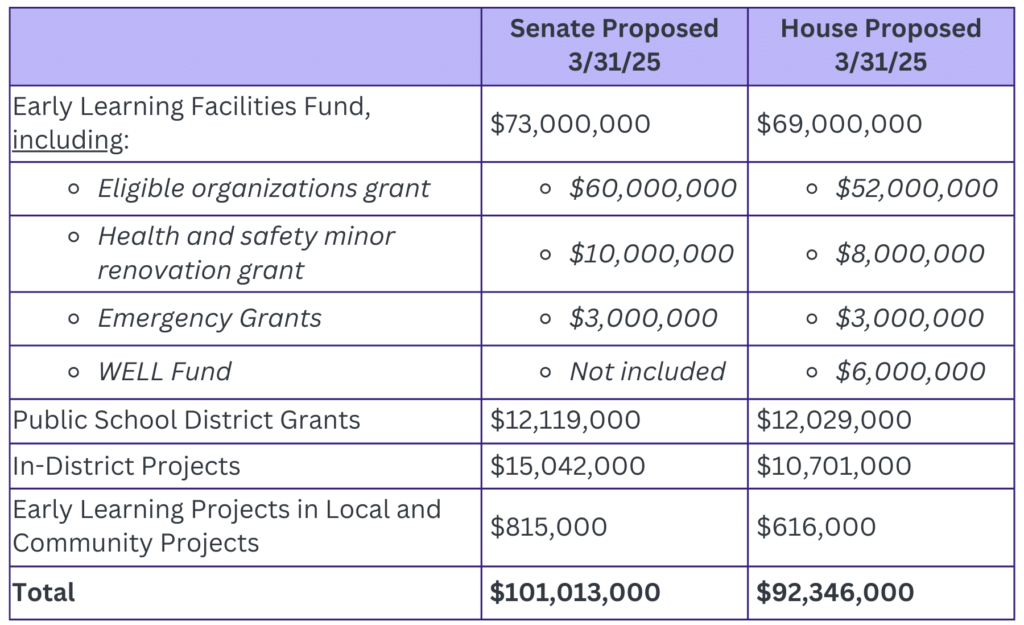

On March 24, the Senate and House released their respective proposed Operating Budgets, PSSB 5167 (Robinson) and PSHB 1198 (Ormsby). On Tuesday, March 25, Start Early Washington released a comparison of the two bodies’ budgetary approaches to early learning. A few notes:

- The chart has been updated in places since its initial release on Tuesday to include a correction. The link on our Policy Resources page includes the latest version.

- The numbers presented include two years of funding for the 2025-27 biennium. If you would like further detail, please reach out.

- The base of the table is Maintenance Level funding, so any reductions are cost savings achieved from reductions from Maintenance Level and new investments are those above what was included in Maintenance Level.

- While funding for early learning and child care does include reductions, many of these are cost avoidance achieved through delayed implementation of upcoming milestones in the Fair Start for Kids Act. Pending legislation (ESSB 5752/HB 1489) would delay these Fair Start provisions.

Budget Highlights

The Senate’s $78.5 billion 2025-27 biennial budget is predicated upon $3 billion in cuts/reductions and $6.2 billion in new revenue in the upcoming biennium. The budget would tap $1.6 billion from the state’s Rainy Day Fund in State Fiscal Year 2026, with a pledge to pay the funds back in the following fiscal year. The budget includes plans to leave a $7.6 billion reserve at the end of state fiscal year 2029.

The Senate budget proposes state employee furloughs of 13 unpaid days for one year (the equivalent of a 5 percent pay cut). The Senate budget invests more than the House in education (particularly in special education) and does not include the $100 million in new funding for law enforcement that is a priority of Governor Ferguson.

The House’s $77.8 billion 2025-27 biennial budget would leave a total ending fund balance of $3.2 billion. Its budget is predicated upon $5.2 billion in new revenue. The House budget does include new funding for law enforcement and while it includes new funding for education, it includes less than the Senate. The House budget does not include salary reductions or require furlough days for state employees.

Budget Approaches to Early Learning

- Areas of Alignment. The two bodies appear to be in alignment on the major cost drivers – delaying expanded eligibility for ECEAP and Working Connections Child Care; pausing additional Transition to Kindergarten enrollment while preserving current enrollment; and delaying by one year Working Connections Child Care rate increases to the 85th percentile of the 2024 Market Rate Survey (MRS).

- Senate invests more in ECEAP. By frontloading a 10% rate increase in year one, the Senate invests ~$10 million more in ECEAP rates and invests substantially more dollars in ECEAP slot expansion.

- Senate budget reflects ESSB 5752 approach. As expected, the Senate budget reflects the ESSB 5752 approach and includes more specific budget reductions, particularly in Working Connections Child Care “auxiliary” programs, than the House. Of interest, of the $6.5 billion in savings in the Senate budget, the largest line-item comes from ESSB 5752 at 14% of the Senate budget’s total savings.

- Fair Start for Kids Act questions dominated press conferences. In various media availabilities over the past week, the large percentage of budget savings coming from early learning was repeatedly noted by the press, and multiple reporters asked questions about the delay to the Fair Start for Kids Act. Legislators from Majority Leader Pedersen to Ways and Means Chair Robinson to House Finance Chair Berg emphasized both the Senate and House are honoring the Legislature’s commitment with the passage of capital gains by dedicating more than $500 million to early learning, but the budget situation did necessitate delaying the Fair Start for Kids Act provisions. Majority Leader Pedersen said the Fair Start for Kids Act showed the demand for services far exceeded what was projected, leading to costs the budget could not accommodate in this environment.

Check out The Washington State Standard coverage of the budget unveilings.

House Democrats Release Revenue Package; Senate Revenue Proposals Set for Hearings

Shortly after we went to “print” last week, House Democrats released their proposed revenue package. Projected to raise over $13 billion over four years (about $4 billion less than the Senate’s), the package contains three components:

- Financial Intangible Tax. The Senate has a similar proposal but is structured differently. The House proposal is expected to bring in $2 billion per year, beginning in fiscal year 2027 and would be dedicated to the Education Legacy Trust Account.

- Property Tax Growth Increase. Focused on increasing funding for public safety and public education, this proposal would allow an increase in annual property tax growth from the current 1% cap to the combined rate of population growth plus inflation, not to exceed 3%.

- Business and Occupations Tax Surcharge. This proposal would impose a 1% Business & Occupation (B&O) tax surcharge on businesses with taxable income over $250 million. The bill also includes an increase to the surcharge on specified financial institutions (approximately 200) with annual net income of $1 billion or more from 1.2% to 1.9%. Under this proposal, Washington would generate nearly $600 million in fiscal year 2026 and nearly $2 billion in fiscal year 2027.

What’s Next for the Budget and Revenue Bills?

The Senate Ways and Means and House Appropriations Committees held public hearings at the same time on their budget proposals, 4:00 p.m. on Tuesday, March 25. Advocates had 60 seconds to provide quick feedback on what was – and what was not – included in the budget proposals.

Both fiscal committees are expected to vote out their budget proposals Thursday night. Lobbyists have been buzzing about whether amendments will be accepted prior to the committee votes. As of this writing, proposed Senate amendments are posted and most of the amendments proposed by Democrats are technical. We will see how many are adopted. Of course, those amendments that cost money will add to the budget challenges.

The Senate is expected to work this Saturday, March 29, to approve their budget. Again, there is the question of whether they will take amendments. The House is expected to take up its budget on Monday, March 31.

Week 12 will kick off with the Senate Ways and Means Committee holding a public hearing on the primary bills that are a part of their revenue package:

- SB 5797 (Frame) – Enacting a tax on stocks, bonds, and other financial intangible assets with revenue dedicated to public schools.

- SB 5796 (Saldaña) – Enacting an excise tax on large employers on the amount of payroll expenses above the social security wage threshold with revenue dedicated toward public schools, health care, and other programs that “protect the safety and wellbeing of the public and provide basic needs assistance for seniors and those with developmental disabilities.”

- SB 5798 (Pedersen) – Concerning property tax growth limit increase with funding dedicated to public schools as well as cities and counties.

- SB 5794 (Salomon) – Eliminating certain tax preferences, with funding dedicated to public schools, health care and social services.

- SB 5795 (Krishnadasan)- Reducing the state sales and use tax rate.

This hearing is scheduled to start at 4:00 p.m. and I’m guessing the Senate Ways and Means Committee members may be in for a long night! As of this writing, the House revenue bills have not been scheduled for a hearing.

These revenue bills are key to budget negotiations because the ultimate revenue number is necessary to know the level of cuts/reductions needed to get to a balanced budget. Of course, budget writers and legislative leadership must ensure they have the votes to pass these revenue bills along with the budget – and also that the Governor will approve them. A lot of negotiation to come!

Bill Updates – Policy Committee Cutoff is Next Week

As a reminder, the policy committee cutoff for bills in the opposite chamber is coming up next week on April 2 and fiscal committees will have a few busy days of work before their April 8 cutoff deadline. Start Early Washington updates our bill tracker each Thursday with the latest information on bills we are following.

Early Learning Facilities Bill Off to Governor Ferguson!

On March 25, the Senate passed HB 1314 (Callan/Abbarno) on a 49-0 vote. Because this bill was not amended in the opposite chamber (the Senate), it does not have to return to the House for Concurrence and will be delivered to the Governor, hopefully for signature.

A priority of the Early Learning Facilities Coalition, HB 1314 seeks to make improvements to the Early Learning Facilities (ELF) Fund. Specifically, HB 1314 would:

- Make Tribal Compact Schools eligible for the ELF public school district program.

- Subject to appropriation, establish an Emergency Grant program for projects that are necessary because of natural disasters or another health or safety threat resulting from unforeseen circumstances.

- Clarify that projects supporting the conversation of ECEAP slots to full day and/or extended day are eligible for ELF Fund grants.

- Remove the level of matching funds as a criterion for selecting projects and make other clarifying changes to matching requirements.

What’s Next for this Bill?

According to Governor Ferguson’s webpage:

“Before the governor signs a bill, it must first be signed in open session in both the Senate and House. Once the house speaker and senate president sign the bill, it’s delivered to the governor’s office. This process can take several days following the passage of a bill by the Legislature.

Bills that are delivered to the governor more than five days before the Legislature adjourns have five days to be acted on. Bills that are delivered fewer than five days before the Legislature adjourns have 20 days to be acted on by the governor.”

It appears HB 1314 will be considered a “five-day” bill and we will report on developments.

Senate Bill to Delay Fair Start for Kids Act Heard in House Policy Committee

On Tuesday, March 25, the House Early Learning and Human Services Committee heard ESSB 5752 (C. Wilson) which would modify aspects of the Fair Start for Kids Act. As noted in the budget section above, the Senate budget proposal reflects savings associated with the statutory changes brought by this bill. Its updated Fiscal Note, showing cost savings of $1.1 billion, was also released on March 24. You can check out our February 28 and March 14 Notes from Olympia to get a recap of the bill’s components.

At the public hearing, early learning advocates registered their concerns with the numerous delays included in the legislation (public hearing on the bill starts at minute 31).

ESSB 5752 is scheduled for Executive Session on Friday, March 28.

Bills to Pause Transition to Kindergarten Continue to Move in Both Chambers

On Monday, March 24, the House Appropriations Committee heard PSHB 2012 (Bergquist) which would limit Transition to Kindergarten enrollment for each school district, charter public school, or state-tribal compact school to its 2024-25 school year enrollment, beginning in the 2025-26 school year. This approach is reflected in the House budget, leading to more than $70 million in biennial savings.

On Wednesday, March 26, the Senate passed another Transition to Kindergarten bill, SB 5769 (Wellman), on a 45-4 vote. Prior to passage, an amendment was adopted that limited funding to the amount included in the state budget, rather than tied to funding for a school year. This approach is also reflected in the Senate budget, creating more than $70 million in biennial savings.

Additionally, the Senate also adopted amendments that:

- Reestablish Transition to Kindergarten as a forecasted program.

- Direct OSPI and DCYF to develop a recommended plan for phasing in the TTK program. The plan must include a phased-in approach for expansion that does not exceed five percent growth in statewide annual average fulltime enrolled students each year.

- Require OSPI to submit a report by December 1, 2027, outlining the plan and recommendations for phasing in future TTK programs beginning with communities with the highest need.

Bill to Modify Child Care Provider Qualifications Receives Further Refining

On March 27, the Senate Early Learning and K-12 Education Committee took executive action on E2SHB 1648 (Dent) related to child care provider qualifications.

At the executive session, the Committee adopted a striking amendment that made the following changes to the bill. (Remember that a striking amendment removes the content of the underlying bill and replaces it with entirely new content).

- Provides that nothing prohibits DCYF from adopting rules that provide timelines beyond August 1, 2028, to allow providers additional time to meet staff qualification requirements based on their date of licensure, hire, or promotion, which can be no more than five years.

- Revises requirements for experience-based competency to include the following:

(a) Requires DCYF to allow licensed child care providers until August 1, 2028, to demonstrate experience-based competency as an alternative to an early childhood education certificate;

(b) Specifies that providers must have been employed without a break in service since August 1, 2021, as of the effective date of this section or a cumulative five years of employment and have completed and maintained compliance with all health and safety and child care or school-age care basics training for this option; and

(c) Provides that nothing prohibits DCYF from establishing more restrictive requirements for providers serving the Early Childhood Education and Assistance Program.

An amendment to the striking amendment maintained the August 1, 2030 the deadline in the underlying bill to comply with child care licensing rules that require early childhood education initial or short certificates, complete the community-based training pathway, or demonstrate experience-based competency. (The striker had proposed moving the deadline up to August 1, 2028).

The bill now moves to the Senate Ways and Means Committee.