Washington State Capitol Building

(Photo Credit: Erica Hallock)

Trivia!

The Capitol Campus is undergoing a great deal of construction. What major campus building is completely closed, necessitating a temporary move four miles away to Tumwater?

Highlights of the Week

A day in Olympia during the legislative session can often feel like a week as the days are filled with committee hearings, legislative meetings and sprinting across the Capitol campus to get to the next appointment.

I have to say the campus feels a tad quieter than usual – even during the Martin Luther King, Jr. Holiday, traditionally a very busy day. It appears people are taking advantage of the virtual option and testifying and meeting virtually rather than making the trek to Olympia. As previously shared, the Washington State Legislature does work on the federal holidays that fall during the legislative session. For the MLK holiday, the Legislature honored the life and legacy of Dr. King during their Floor session.

In many ways, we are readjusting to an in-person legislative session. It is a bit like riding a bike; some days, we may be missing a wheel! Note that despite fewer people on campus, parking can still be challenging as a staff parking lot has been converted to a temporary building and the DASH shuttle is not in service this year.

Senate Early Learning and K12 Committee Work Session on Early Learning. On Wednesday, Jan. 18, the Senate Early Learning and K12 Committee held a work session on a number of early learning topics, including the implementation of the Fair Start for Kids Act, the Recommendations from the Child Care Collaborative Task Force, and recommendations for child care workforce and compensation (starts at the 1:00 mark).

The presentation kicked off with Allison Krutsinger from the Department of Children, Youth, and Families (DCYF) providing updates on the implementation of the Fair Start for Kids Act (starts at 1:01) and COVID-related grants (starts at 1:08 mark).

Next was an update on the Child Care Collaborative Task Force, which was housed at the Washington Department of Commerce and co-convened with DCYF. The Task Force was charged with developing recommendations to improve access to child care, a new approach to the child care subsidy model and strategies for businesses to support child care (starts at the 1:11 mark). Co-Chairs Ryan Pricco (Child Care Aware) and Amy Anderson (Association of Washington Business) presented the most recent recommendations focusing on the true cost of quality child care, including background on the cost estimation model (starts at the 1:13 mark) followed by the four recommendations. An interesting discussion on the future of Early Achievers starts at the 1:22 mark.

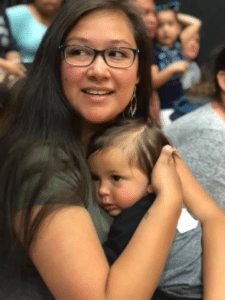

Finally, Meka Riggins (Child Care Aware) presented on the Liberatory Design Process undertaken to develop recommendations related to workforce recruitment and compensation recommendations (starts at the 1:30 mark). Child Care Aware convened a diverse set of child care providers to discuss challenges and opportunities in the field and design recommendations and advocacy priorities for the workforce. The design team’s recommendations start at the 1:36 mark. Finally, the committee heard from providers Desiree Hall from Stay and Play Child Care Learning Center in Seattle, Nicole Sohn from the Discover Journey Center in Spokane, a family home provider Holly Lindsey in Longview, and Lupe Mendoza, a parent from Walla Walla, on field experiences (starts at the 1:38 mark).

Sen. Patty Murray Holds Capitol Early Learning Press Conference. U.S. Senator Patty Murray, new Chair of the Senate Appropriations Committee, hosted a press conference on child care at the Legislative Building Wednesday, Jan. 18. Susan Lee, Director at the Refugee Women’s Alliance, spoke along with Lauren Hipp from MomsRising. Child care champions State Senator Claire Wilson and State Representative Tana Senn also spoke and were joined by Sen. Jesse Solomon, Rep. Lillian Ortiz-Self, Rep. April Berg, and Rep. Monica Stonier.

Sen. Murray described the challenges in child care today, such as providers lacking sufficient funds to stay open; limited child care options; the need for facilities particularly in rural areas; child care staff leaving the workforce for better paying jobs in the retail and food service industry; and the lack of affordable options for parents.

Sen. Murray noted that the recent federal spending bill increased federal child care investment by over 30% or $1.8B. This increase is expected to provide additional funding for child care access to an estimated 130,000 more children. However, Sen. Murray was clear that bold action is needed and we are still a long way from saying “mission accomplished.”

State Sen. Claire Wilson and State Representative Tana Senn spoke to the increased state investment in child care over the past several years. This included the passage of the 2021 Fair Start For Kids Act, which provided an additional $1.1B in investments, including reduced family co-pays, bonuses for non-standard hours, increased home-based services such as home visiting, and grants to early learning providers to remain open.

What’s on Deck for Next Week

Dairy Day! Who doesn’t love free food? Particularly when that free food involves ice cream and cheese!

One of the biggest highlights of the legislative sessions is the “food days.” The food days involve various food-related associations coming to the Capitol to demonstrate the value of their product to the state of Washington. These “food days” generate an unbelievable level of excitement. It is kind of like when you were in elementary school, and there was an assembly with a person doing all of the yo-yo tricks. We are all giddy!

If you are on campus on any of these days, you will witness long lines of people patiently waiting for free potatoes, beef or ICE CREAM! The first food day is scheduled for next week on Jan. 25 with Dairy Day. The mezzanine around the third floor of the Legislative Building will be filled with representatives of the Washington State Dairy Association handing out free ice cream, cheese and yogurt. It will be a very good day.

Photo proof that I have been enjoying ice cream giveaways at capitals for decades (June 1992, Washington, D.C.)

(Photo Credit: Erica Hallock)

Oral Arguments Before State Supreme Court Jan. 26. On Jan. 26, the Washington State Supreme Court is scheduled to begin hearing oral arguments on the constitutionality of a capital gains tax in its temporary building in Tumwater.

The Supreme Court has already acted to allow the State Department of Revenue to begin collecting the tax prior to the Court’s final ruling and all the revenue forecasts assume receipt of this revenue. The funding is primarily designed to support the implementation of the Fair Start for Kids Act.

Helpful Legislative Engagement Tips and Legislative Cutoff Dates

I am all about not reinventing the wheel. On Sunday, Jan. 15, the Spokesman Review’s Jim Camden had an informative column compiling resources to help stay engaged with the legislative process. Check it out!

Legislative Cutoff Calendar. The 105-day “long” legislative session moves really fast and it won’t be long before we are facing “cutoff” deadlines. These cutoffs are designed to serve as a filter, reducing the number of bills considered throughout the process. The first cutoff is scheduled on day 40 (Feb. 17), when all bills must be approved by their respective policy committees. From that point, the cutoff dates come at a quicker clip, with the fiscal cutoff scheduled for day 47 (Feb. 24).

This cutoff calendar is particularly important to review if you are planning to visit the Capitol as there is always a swirl of activity around these cutoff dates.

Bill Tracker: Key Early Learning Bills

As the legislative session progresses, our resource page will update with a weekly bill tracker. Please note that legislation changes quickly, so the version on our website may not represent a bill’s latest version as it is published the Thursday of each week.

For over 40 years, Start Early has worked directly with families and children from before birth to entry into kindergarten. We

For over 40 years, Start Early has worked directly with families and children from before birth to entry into kindergarten. We  Early childhood educators serve young children in their most critical developmental years and

Early childhood educators serve young children in their most critical developmental years and  Our Capitol Ambassador Ollie loves fresh snowfall

Our Capitol Ambassador Ollie loves fresh snowfall Newly Elected Members to the House of Representatives

Newly Elected Members to the House of Representatives