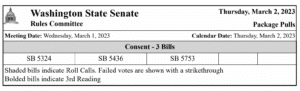

A rainy start to week ten

(Photo Credit: Erica Hallock)

Trivia!

The Irv Newhouse Building on the Capitol Campus could be demolished as early as today to make way for a new Senate office building. What was the Newhouse building’s original name?

Legislative Lowdown

State revenue forecasts. Programs, services and institutions supported by the state government are funded by revenue from state taxes and fees as well as a few other sources, such as the federal government. As you may recall from a previous story, the Legislature must adopt four-year balanced budgets based on anticipated revenue.

Since 1984, the state has generated nonpartisan economic and revenue forecasts, which are overseen and approved by the Economic and Revenue Forecast Council (Council). The approved forecasts serve as the basis for state budgeting. The Council currently includes four bipartisan legislators, the leaders of the state Department of Revenue and the Office of Financial Management, as well as the State Treasurer Mike Pellicciotti. In addition, the agency has five staff including its Executive Director Dr. Steven Lerch, Ph.D. — the state’s Chief Economist.

Forecasts are developed four times a year, with the November revenue forecast serving as the basis of the Governor’s Proposed Budget, released annually each December. The revenue forecast released in February (even-numbered years) or March (odd-numbered years) provides the latest revenue estimates for legislative budget writers.

The economic forecasts consider a variety of factors that could impact the state’s economic condition, including overall economic growth (GDP), employment data, inflationary data, consumer spending habits, interstate and international trade, strength of the dollar, major global events impacting trade (ex., War in Ukraine), among other key factors. See the March 2023 Economic Review as an example of the complexities of these analyses. The revenue forecast will include an official projection of revenues as well as optimistic and pessimistic forecasts.

Here is the methodology and detailed information on calculated costs, revenues and caseload forecasts related to the Governor’s Proposed Budget for the 2023-25 legislative biennium, as an example. Revenue and cost drivers include revenues and fees coming into the state coffers, caseload assumptions for major programs (ex., state-funded health care, prisons, etc.), increased costs of doing business, costs of tentative union collective bargaining agreements (CBAs), cost-of-living adjustments for the state pension and retirement programs, debt service and new gubernatorial policy and related funding priorities for the upcoming session.

The March 2023 revenue forecast will be released at 2 p.m. on March 20 and can be viewed on TVW. We expect both the Senate and House will release their respective Operating, Capital and Transportation budgets shortly after the revenue forecast.

Following the release of the budgets, the Senate and House fiscal committees will hold public hearings for groups and individuals to provide feedback about what is (and, more importantly, is not) included. As of this writing, the Senate Ways and Means Committee has a 4 p.m. public hearing on March 20 for the proposed Capital Budget as well as a 2 p.m. public hearing on March 24 for their proposed Operating Budget. House budgets are expected the week of March 27.

After the release of the respective budget proposals, the Senate and House will each appoint a “conference committee.” These conference committee members will work to resolve differences between the two bodies’ approaches prior to the release of finalized 2023-25 budgets that will be considered by both chambers prior to adjournment of the 2023 legislative session.

Bill Tracker: Key Early Learning Bills

As the legislative session progresses, our resource page will update with a weekly bill tracker. Please note that legislation changes quickly, so the version on our website may not represent a bill’s latest version as it is published the Thursday of each week.

Late Senator Irv Newhouse

Late Senator Irv Newhouse Dorothy Hibbard Newhouse, Congressman Dan Newhouse, Senator Judy Warnick, Senator John Braun and Secretary of the Senate Sarah Bannister, 2/16/23

Dorothy Hibbard Newhouse, Congressman Dan Newhouse, Senator Judy Warnick, Senator John Braun and Secretary of the Senate Sarah Bannister, 2/16/23 Congressman Dan Newhouse views the sign in honor of his father, 2/16/23

Congressman Dan Newhouse views the sign in honor of his father, 2/16/23 (Photo Credit: Erica Hallock)

(Photo Credit: Erica Hallock)

Frigid winter weather hits the Du Pen Fountain in front of the Joel Pritchard Building.

Frigid winter weather hits the Du Pen Fountain in front of the Joel Pritchard Building.

(Photo Credit:

(Photo Credit: Washington State House of Representatives Members of Color Caucus, 2023-2024 – Not pictured: Rep. Cindy Ryu

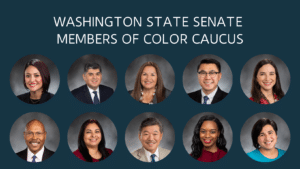

Washington State House of Representatives Members of Color Caucus, 2023-2024 – Not pictured: Rep. Cindy Ryu Washington State Senate Members of Color Caucus, 2023-2024

Washington State Senate Members of Color Caucus, 2023-2024 (Photo Credit: Erica Hallock)

(Photo Credit: Erica Hallock)

(Photo Credit:

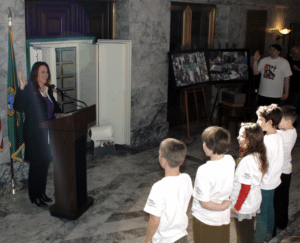

(Photo Credit:  Surrounded by bill supporters, former Washington Governor Christine Gregoire signs legislation establishing full legal rights for same-sex couples to marry on Feb. 13, 2012

Surrounded by bill supporters, former Washington Governor Christine Gregoire signs legislation establishing full legal rights for same-sex couples to marry on Feb. 13, 2012 Displays include photos and personal stories

Displays include photos and personal stories (Photo Credit: Erica Hallock)

(Photo Credit: Erica Hallock) The Legislative Building from the north side on Super Bowl Sunday.

The Legislative Building from the north side on Super Bowl Sunday. Former Washington State Secretary of State Ralph Munro (in top hat) and former Governor Booth Gardner with original “Capsule Keepers” at the Nov. 11, 1989 celebration at the Capitol.

Former Washington State Secretary of State Ralph Munro (in top hat) and former Governor Booth Gardner with original “Capsule Keepers” at the Nov. 11, 1989 celebration at the Capitol. Original “Keeper of the Capsule” Jennifer Estroff (in red holding a capsule) alongside former Secretary of State Kim Wyman (far right), Time Capsule Organizer Knute Berger (far left) and other 1989 Capsule Keepers on February 2015

Original “Keeper of the Capsule” Jennifer Estroff (in red holding a capsule) alongside former Secretary of State Kim Wyman (far right), Time Capsule Organizer Knute Berger (far left) and other 1989 Capsule Keepers on February 2015 Former Secretary of State Kim Wyman swears in a new batch of “Capsule Keepers” in 2015

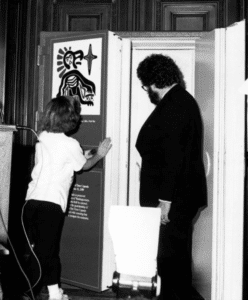

Former Secretary of State Kim Wyman swears in a new batch of “Capsule Keepers” in 2015 Knute Berger oversees the closing of the capsule in 1989

Knute Berger oversees the closing of the capsule in 1989

Senator Yasmin Trudeau and her effective assistant

Senator Yasmin Trudeau and her effective assistant (Photo Credit:

(Photo Credit:  Farmer-Labor Party Logo

Farmer-Labor Party Logo