Olympia prepares for Capital Lakefair 2023: An annual family-friendly festival complete with rides, fireworks and elephant ears!

Olympia prepares for Capital Lakefair 2023: An annual family-friendly festival complete with rides, fireworks and elephant ears!

Happy New Year! – Fiscal New Year, That is! July 1 signals the start of a new fiscal year and – in odd-numbered years – the start of a new biennium. While our wall calendars may say 2023, Washington state government is in State Fiscal Year 2024 as fiscal years run from July 1 through June 30. If you manage a state contract, you are likely well aware of this transition, as the end of a fiscal year often brings a flurry of activity to allow state agencies to “close their books.”

Many new laws go into effect at the start of new fiscal years, including the controversial drug possession law in response to the “Blake Decision.” For example, the 2021 Fair Start for Kids Act laid out a number of milestones to increase access and affordability to quality early care and education. Per the Fair Start for Kids Act, effective July 1, 2023, Working Connections Child Care monthly copayments for families earning between 50-60% of the State Median Income rose from $115 to $165 a month. The Fair Start for Kids Act also provided that at the start of the next biennium (July 1, 2025), eligibility for Working Connections Child Care will rise from 60% of the State Median Income to 75% of the State Median Income (rising from $4764 to $5955 a month for a family of three). Here’s a breakdown summary from our resources page.

State Revenue Updates

On June 27, the Washington State Economic and Revenue Forecast Council met to receive the final revenue report for state Fiscal Year 2023. The forecast projects higher than expected revenue for the biennium that just ended as well as for the upcoming 2023-25 and 2025-27 biennia. These increases are largely thanks to projected increases in capital gains revenues. For example, of the $327 million revenue increase forecasted for the 2023-25 biennium we just entered, $108 million can be attributed to higher than anticipated capital gains receipts and $89 million in higher sales tax revenues.

As a reminder, 2021 legislation affirmed by the Washington State Supreme Court in early 2023 created a 7 percent tax on the sale or exchange of certain capital gains assets valued above $250,000. The law took effect Jan. 1, 2022 and first payments were due by April 18, 2023. The enacting legislation provided that the first $500 million received be directed toward the Education Legacy Trust Account (ELTA) to support early learning and public schools and any dollars received above $500 million be deposited into the Common School Construction Account (CSCA).

Decision Package Process

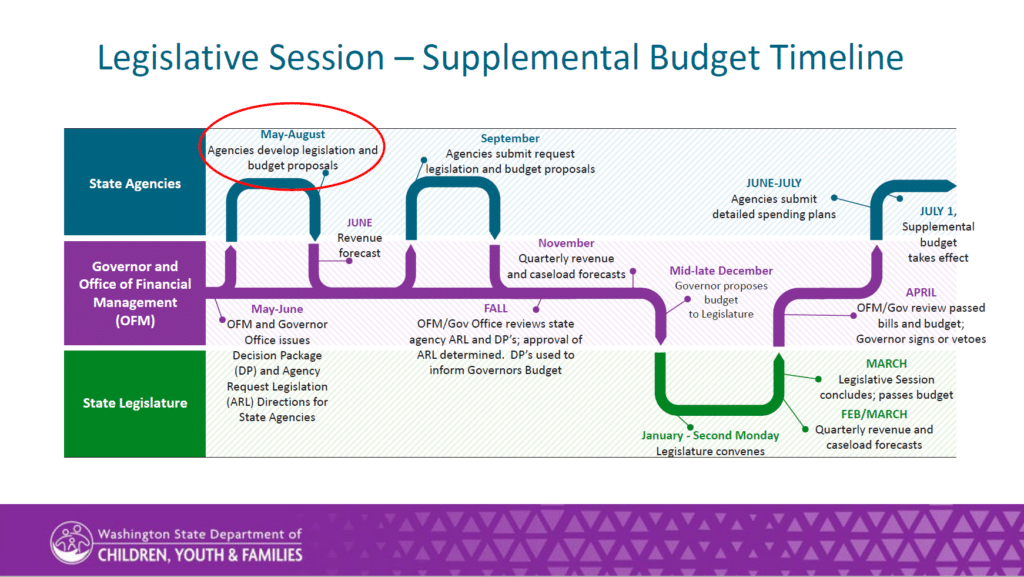

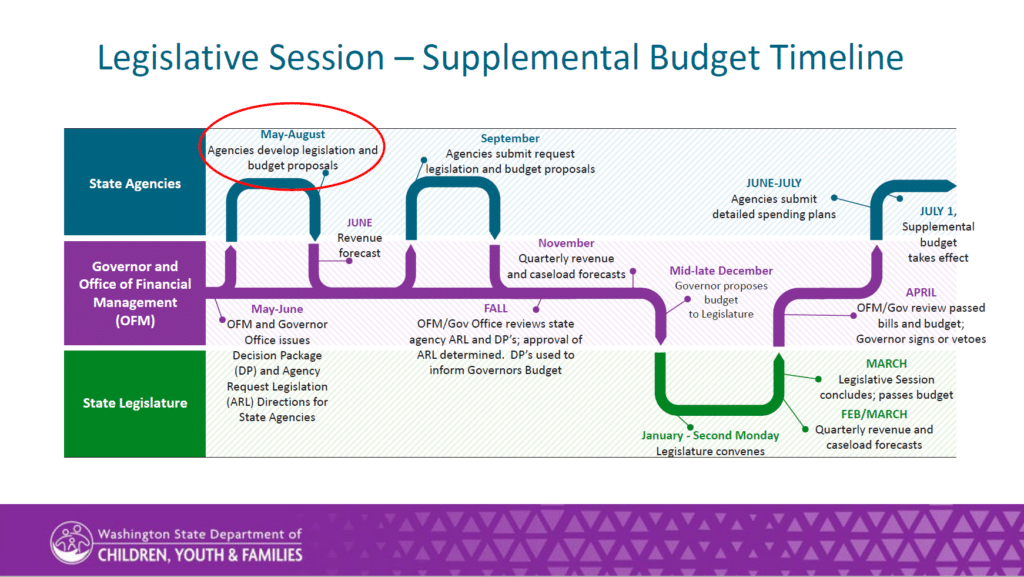

(Photo Credit: Department of Children, Youth and Families)

As the graphic above demonstrates, there is little “downtime” in the state budgeting process because state agencies begin planning for budget requests for the next legislative session before the ink is even dry from the previous legislative session.

Like the legislative process, state budgeting also serves as a “funnel,” with the number of viable proposals narrowing down throughout the process.

Following direction provided by the Governor’s budget shop (the Office of Financial Management, or OFM), state agencies work over the summer months reviewing, vetting and modeling potential budget proposals (referred to as decision packages – or “DPs”) as well as agency request legislation (ARLs). This is a very intensive process as agencies weigh this executive guidance and agency priorities with other practicalities (e.g., supplemental budget year, legislative appetite, etc.).

In September of each year, state agencies officially submit their decision package and agency request legislation ideas to the Office of Financial Management (OFM). OFM then publishes all the submitted documents on its website so the information is available to the public. Once state agencies submit their proposals, the focus turns to OFM staff and the Governor as they enter “budget build,” reviewing the various decision packages and agency request legislation proposals.

This part of the process culminates in the release of the Governor’s proposed budget in mid-December annually. Note that even though we will have a new Governor in 2025, Governor Inslee will submit a final two-year budget in 2024 prior to leaving the Governor’s office.

It is also important to note that once the Governor’s budget is released, state agencies can only advocate for proposals contained therein. This means that if one of their decision packages was not included in the Governor’s budget, that state agency is limited to answering technical questions about the program/service and cannot advocate in the same way they can if the item is funded in the Governor’s budget. For this reason, decision packages have a short “shelf life.” Once the Governor’s budget is released, decision packages really only serve to provide data points and cost modeling information.

We will share a summary of key decision packages and agency request legislation after their release in September. In the meantime, check out our Deep Dive section from August for a refresher on how the decision package process works.

Impending Changes

(Photo Credit: Image by wirestock on Freepik)

Dominos Falling … I recently scrolled through the legislative website and was struck by the magnitude of change Olympia will see – regardless of the 2024 elections – and we have not even reached the time during election years when lawmakers looking to retire announce they are not seeking reelection. These announcements typically occur toward the end of the short legislative session in even-numbered years.

Governor Jay Inslee’s decision to not run for a fourth term as Governor set in motion falling dominos with the offices of Attorney General and Public Lands Commissioner opening up as those incumbents threw their hats in the ring for the Governorship. Shortly thereafter, longtime Insurance Commissioner Mike Kreidler announced he, too, would not seek another term.

These announcements set up a flurry of potential movement in the Legislature, particularly in the Senate, with at least four sitting Senators signaling interest in pursuing statewide elected office. Of course, some of these Senators could change their mind and decide not to run, or their quest for statewide office could come in a year when they are not up for reelection, so they would not have to give up their Senate seat if they did not prevail. If any sitting Senators do give up their Senate seats to seek statewide office, we can expect a number of their House of Representative seatmates to show interest in those Senate seats. More dominoes …

We already know the 2024 legislative session will not include longtime Senate Ways and Means Chair Christine Rolfes as she resigned her Senate seat effective mid-August to serve on the Kitsap County Board of Commissioners. Kitsap County Democratic Precinct Committee Officers selected Senator Rolfes’ House seatmate Drew Hansen as its top choice to fill the empty seat. The Kitsap County Board of Commissioners will make the final decision.

Legislative sessions are never boring and the magnitude of impending changes in personnel will make the “palace intrigue” of Olympia all the more fascinating.

Thank you for reading our newsletter!! Your feedback is incredibly important to us. Please take a few minutes to let us know how we are doing.

brief survey

Olympia prepares for

Olympia prepares for

The Capitol Campus is just showing off …

The Capitol Campus is just showing off … The year of this photo is unknown, but my educated guess is the late 1960s- early 1970s based on the snazzy fashion choices.

The year of this photo is unknown, but my educated guess is the late 1960s- early 1970s based on the snazzy fashion choices. Newhouse Building construction as of May 4, 2023

Newhouse Building construction as of May 4, 2023