The Tivoli Fountain on a Warm Spring Day

(Photo Courtesy: Erica Hallock)

Trivia!

Prior to the Legislature moving to annual legislative sessions in 1980, bi-annual sessions ran for how many days?

Highlights of the Week

Revamped Revenue Approach on the Table

After Governor Ferguson conveyed his unwillingness to support a “wealth tax” to help close the state budget gap at an April 1st press conference, legislative budget writers went back to the drawing board. This week they unveiled a revised revenue package that is estimated to raise $12 billion over four years. As a reminder, the state’s four-year budget gap is an estimated $16 billion.

This Washington State Standard article summarizes this revised legislative approach.

While a number of revenue bills are in play, five primary pieces currently make up the revised Senate and House revenue packages. They include:

- SB 5812 (Wellman)/HB 2049 (Bergquist) K-12 Education Funding/Property Tax

- These companion bills increase the revenue growth limit for state and local property taxes to fund K-12 education

- SB 5813 (C. Wilson)/HB 2082 (Street) Increase Funding to the Education Legacy Trust Account/Capital Gains & Estate Tax Increases

- Adds an additional 2.9% excise tax on capital gains in excess of $1M

- Increases the top tier rates on estate tax by 35% and increases the exclusion amount for the estate tax to $3M

- SB 5815 (Saldana)/HB 2081 (Fitzgibbon) Increase Business & Occupations (B&O) Tax

- Increases tax rate for several Business & Occupations (B&O) Tax Surcharges

- Includes an increase of the B&O rate for child care from .484% to .5% effective January 1, 2035

- Imposes surcharge on high grossing businesses and financial institutions

- Places a .5% tax on Washington taxable income over $250M. Takes effect January 2026 and expires December 31, 2030

- SB 5814 (Frame)/HB 2083 (Stonier) Extend Retails Sales and Use Taxes to Certain Services/One-Time Pre-Payment of Sales Tax Collections

- Extends retail sales and use tax to certain services

- Makes certain nicotine products subject to the other tobacco products tax

- Establishes one-time pre-payment of state sales tax collections for businesses with $3M or more in taxable retail sales during calendar year 2026. Pre-payment in June 2027 for July 2027 taxes. Effect is to pull ~$800M in sales tax revenue into the 2025-27 biennium

- SB 5794 (Salomon)/HB 2084 (Ramel) Repeal or Modification of Certain Tax Preferences

- These bills repeal, modify or clarify a number of tax exemptions to raise additional revenue

The Senate Ways and Means Committee held a public hearing on most of its revenue bills on Wednesday, April 16, and is scheduled to take executive action on Friday, April 18. The House Finance Committee is scheduled to hold both public hearings and executive sessions on Friday, April 18.

All of these revenue bills are “Necessary to Implement the Budget,” and, therefore, not subject to legislative timelines, but still need to go through all of the normal channels and be approved by both bodies.

On April 17, Governor Ferguson issued his response to the revenue package. Of note, he expressed concern that the Legislature’s approach continues to rely on too high a level of new revenue. The statement did not include a specific target revenue figure, and the reader could infer he prefers further cuts rather than the proposed level of revenue.

Specifically, he stated:

“At a time of great economic uncertainty and assaults by the Trump Administration on core state services for working families, raising $12 billion in taxes is unsustainable, too risky and fails to adequately prepare Washington state for the crisis that looms ahead.

That said, the Legislature has made progress on key issues in its updated revenue proposals. Legislators are working hard and putting in long hours. They have moved away from their reliance on an untested wealth tax and made progress on addressing our regressive tax system.

We will continue to work together to produce a budget that supports a strong economy, and the people of Washington.”

“It’s the Final Cutoff”

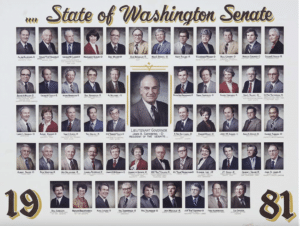

As a nod to the Blue Origin “space trip” this week, I wrote this title line while singing Europe’s “The Final Countdown” in my head. I will forever be a child of the 1980s – best music, no question.

Wednesday, April 16 at 5:00 p.m. was the final cutoff with the deadline for bills to pass out of the opposite chamber. In other words, House bills had to be passed by the Senate and Senate bills passed by the House. Bills “Necessary to Implement the Budget” are not subject to these cutoff deadlines.

Per the usual pattern this session, the House had a number of late night/early morning workdays, while the latest the Senate worked was, maybe, 7:00 p.m. one day.

Check out Start Early’s Bill Tracker to get the latest bill statuses.

Process Check-In

1. What Happens After a bill has passed both the House and the Senate?

The answer depends on whether the bill was amended in the opposite chamber.

If a bill was not amended in the opposite chamber, the bill is sent to the Governor for his consideration after receiving signatures of the President of the Senate and Speaker of the House.

If the bill was amended in the opposite chamber, it must return to the originating chamber for a process called “Concurrence” where the originating body is asked to agree to the amendments made in the opposite chamber. For example, if a House bill is amended in the Senate, it must return to the House so the House can concur with the Senate amendments. If concurrence occurs, the bill makes its way to the Governor’s desk. Much of the focus of these final days of session will be spent in this process of Concurrence.

2. What Happens when the House of Origin Does Not Concur with the Opposite Chamber’s Amendments?

If the original chamber does not agree with the amendments made in the other body, it can request that the opposite chamber withdraw – or recede – their amendments.

If the opposite chamber refuses to recede, a conference committee including representatives from each chamber may be formed. This conference committee works to resolve differences and ultimately produce a conference committee report outlining this resolution. Both the Senate and House must adopt the conference committee report for the bill to pass (in other words, it is an up or down vote). If the conference committee does not come to an agreement or if one of the chambers does not agree with the conference report, the bill fails. Because conference committees take time and energy in the waning days of session, creation of conference committees are not taken lightly.

Revenue Collections Update

On April 14, the state’s Economic and Revenue Forecast Council released an Economic and Revenue Update. Of note, major General Fund-State (GF-S) revenue collections for the March 11 – April 10, 2025, collection period came in $76.7 million (3.8%) lower than forecasted. A large part of this comes from real estate excise tax (REET) collections which came in $17.4 million (14.7%) lower than forecasted.