A foggy start to week ten…

(Photo Courtesy: Erica Hallock)

Trivia!

Former Washington State Legislative House of Representatives Member Catherine May was the first woman elected to the United States Congress from Washington State. Which community did she represent?

Highlights of the Week

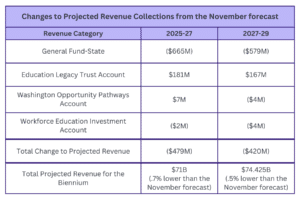

Updated Revenue Forecast Shows Declining Revenues

On Tuesday, March 18, the Washington state Economic and Revenue Forecast Council met to receive an updated revenue report from the state’s economist, Dave Reich.

Bottom line up front, the state’s revenues are projected to decline by $899M from the November forecast for the 2025-2029 biennia. They are proposed to be $479M lower for the 2025-27 biennium and $420M lower for the 2027-29 biennium.

On a more upbeat note, the forecast does show revenues for the current biennium, 2023-25, are expected to be $54M higher than what was projected in November.

Primary reasons for the reduced revenue projections include decreased sales and business and occupancy tax collections as well as overall elevated risks due to activity at the federal level. Specifically, Economist Reich mentioned federal tariffs policy as a particular risk to our state’s economy.

The next revenue forecast will be in June. Director Reich referenced several times that activity at the federal level (federal employee layoffs, tariffs, overall federal policy decisions) will likely impact that June forecast.

Senate Democrats Release Proposed Revenue Package

On Thursday, March 20, Senate Democrats released a proposed revenue package designed to offset deeper budget cuts. The proposed package includes:

- Financial Intangibles Tax. Intended to raise roughly $4B a year beginning in fiscal year 2027 for public schools (with a focus on increased funding for special education), this proposal would levy a tax of $10 on every $1,000 of assessed value of certain financial assets held by individuals with more than $50M of these assets.

- Removing the Cap on Payroll Taxes. This proposal would place a 5% tax on large employers on the amount of payroll expenses above the Social Security threshold and would be limited to companies with $7M or more in payroll expenses. Similar to Seattle’s “JumpStart” tax, it is expected to raise about $2.3B a year once fully implemented and would be dedicated toward public schools, health care, and other programs that “protect the safety and wellbeing of the public and provide basic needs assistance for seniors and those with developmental disabilities.”

- Allowing Property Tax to Grow by Population and Inflation. This proposal would raise the property tax growth for the state’s common schools levy and for cities and counties as well as special purpose districts from the current 1% cap to the combined rate of population growth plus inflation. It would exempt participants in the “Property Tax Exemption for Senior Citizens and People with Disabilities” program from the state property tax. The state property tax is dedicated to public schools with about $779M in additional funding expected over the four-year budget cycle, with increased funding expected as well for cities and counties.

- Repealing Ineffective and Obsolete Tax Preferences. This proposal would repeal 20 tax exemptions, generating just over $1B over the four-year budget cycle for public schools, health care and social services.

- Cutting the Regressive Sales Tax. The final proposal would reduce Washington’s sales tax from 6.5% to 6%, resulting in a decrease of approximately $1.3 billion per year in revenue.

Joint Session to Memorialize Deceased Legislators

On Wednesday, March 19, the State Senate and House of Representatives held a joint session in the Senate Chambers to memorialize the 18 late Senate and House members who passed away over the past year.

(Photo Courtesy: Erica Hallock)

Family members of the departed legislators sat in the Senate gallery to witness the lovely and solemn event that included a flute performance by Senate Majority Leader Jamie Pedersen.

A rare look into the Senate Chamber via the Chamber doors which only open on special occasions

(Photo Courtesy: Erica Hallock)

Effort to Create More Specialty License Plates Stalls – Sorry Smokey!

In our February 28 edition of Notes from Olympia, I reported on an effort to create seven new specialty license plates, including one honoring Smokey the Bear. I’m sorry to report that legislation, HB 1368 (Orcutt), died in House Rules and will not advance this year. There’s always next time!

What’s on Deck for Next Week

Senate and House Budgets to be Released – Feedback Opportunity

Both the Senate and House will release their proposed 2025-27 operating budgets on Monday, March 24 with public hearings in the respective Senate Ways and Means and House Appropriations Committees the following day, March 25 at 4:00 p.m.

Public Input Opportunity. Both the Senate Ways and Means and House Appropriations Committees accept in-person, virtual as well as written testimony. If you would like to testify in-person or virtually, you must sign-up no later than 3:00 p.m. on Tuesday, March 25. Written testimony will be accepted up until 4:00 p.m. on Wednesday, March 26.

Follow these links to provide in-person, virtual, or written testimony:

- House Appropriations Committee

- Senate Ways and Means Committee (note that the Senate Ways and Means Committee accepts testimony by issue area)

Start Early Budget Summary. Start Early plans to produce a special edition of “Notes from Olympia” early next week with a summary of the Senate and House budget details. Be on the lookout!

Budget Executive Session Scheduled. Following Tuesday’s public hearings on the budget proposals, the Senate Ways and Means and House Appropriation Committees will hold Executive Sessions on these budget bills on Thursday, March 27 at 4:00 p.m. Given the budget situation, it will be interesting to see the number of amendments to the original budget proposals that are accepted. Following the executive session (vote) in the fiscal committees, the two bodies will vote on their budget proposals in their respective chambers and budget writers will work to negotiate a final budget compromise that can secure enough votes for passage (and approval by Governor Ferguson), all hopefully by Sine Die (adjournment) on April 27.

Policy Committee Work Continues in Advance of April 2 Cutoff

Policy committees continue their work reviewing bills from the opposite chambers in advance of the April 2 policy committee cutoff. Note that we are seeing a number of “Necessary to Implement the Budget” bills come into play, particularly those related to changing the statute to achieve budget savings.

For example, ESSB 5752 (Wilson) which would generate a number of savings for the budget by delaying aspects of the Fair Start for Kids Act and moving a number of early learning programs to “Subject to Appropriation,” is scheduled for a public hearing in the House Early Learning and Human Services Committee on March 25 and for executive session on March 28. (See our March 14 Notes from Olympia for details on the bill).

Additionally, HB 2012 (Bergquist) which would pause enrollment in the Transition to Kindergarten program to create budget savings is scheduled to be heard in the House Appropriations Committee on Monday, March 24.

I am keeping a close eye on the bill introduction lists of new bills, those proposing cuts as well as new revenue. Those bills, introduced this late in the session, still need to advance through all of the steps but it is a much smoother process when there is agreement among leadership in both chambers. As a reminder, each Thursday, Start Early Washington updates its bill tracker with the latest information on bills we are following.